A new report from Reuters claims that ByteDance is developing an AI chip and is in talks with Samsung Electronics about manufacturing, as major tech firms race to secure compute and reduce reliance on scarce external supply. The TikTok parent aims to receive sample chips by end-March and plans to produce at least 100,000 units this year, potentially scaling to 350,000 units, according to sources cited by Reuters.

The chip, internally codenamed SeedChip, is being designed specifically for AI inference tasks—the process of running trained models to answer user queries in real time. A ByteDance spokesperson told Reuters “the information about ByteDance’s in-house chip project is inaccurate,” without providing further details. Samsung has not spoken publicly about the subject.

Inference becomes the new bottleneck

TikTok processes billions of video recommendations every day. ByteDance’s Doubao chatbot, launched in 2023, handles millions of queries across e-commerce, short video, and cloud platforms. Operating at that scale means thousands of inference chips running continuously, retrieving and processing data fast enough to feel instant to users.

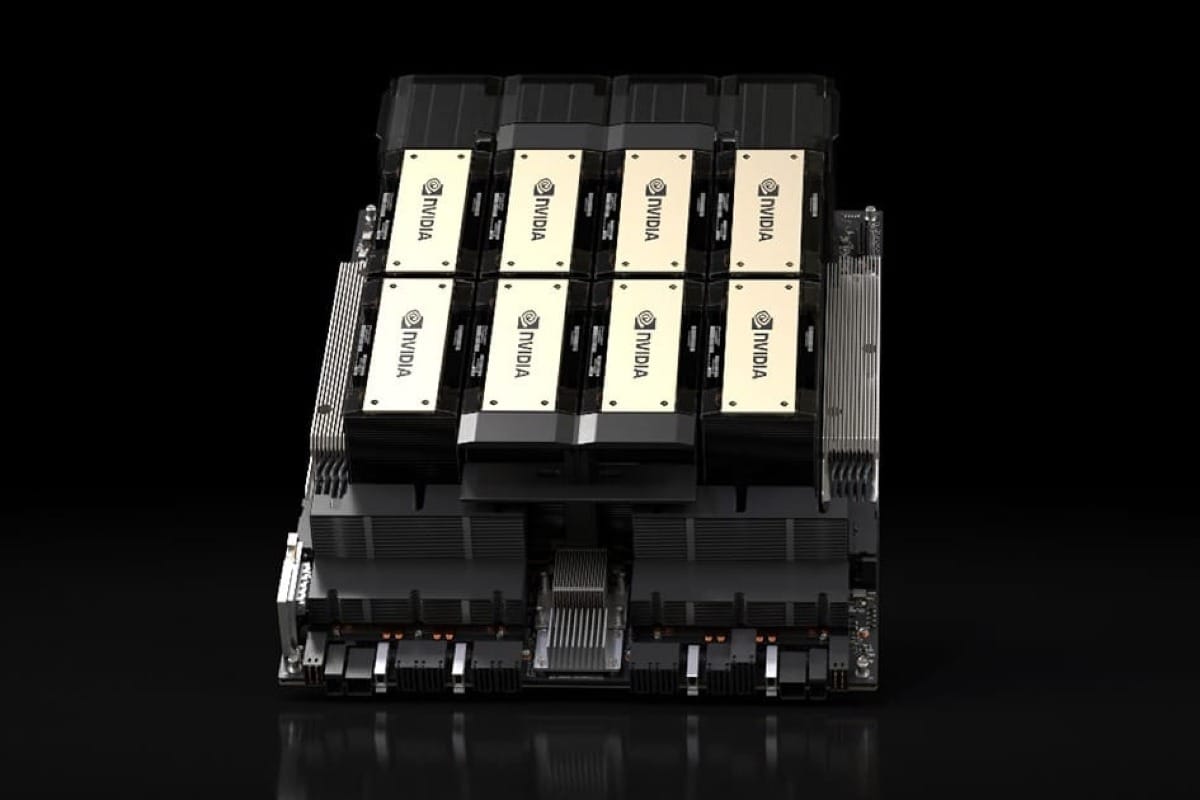

The economics explain the urgency. ByteDance plans to spend over 160 billion yuan ($22 billion) on AI procurement this year, according to the report. More than half it says would go toward Nvidia H200 chips and developing in-house alternatives.

To put that in perspective: ByteDance’s AI budget, if the reports are true, would equal the GDP of several small nations and represents roughly 10% of the company’s estimated annual revenue. Building custom inference processors would cut dependence on Nvidia’s GPUs, which remain in severe shortage as global AI infrastructure expands.

What makes the Samsung deal valuable

The reported negotiations extend beyond standard chip manufacturing to include access to high-bandwidth memory (HBM) supplies—a critical component experiencing acute shortages worldwide. That dual arrangement could solve two problems in one deal.

Memory bandwidth often becomes the bottleneck before compute power does. Inference chips constantly pull data from memory to process requests, and without sufficient bandwidth, even the fastest processors slow down. Securing both fabrication capacity and memory supply simultaneously gives ByteDance an edge competitors lack.

The company started building its semiconductor team in 2022. Reuters previously reported ByteDance was working with Broadcom on an AI processor destined for TSMC manufacturing, suggesting the Samsung discussions could represent either a strategic pivot or parallel development to diversify supply chains.

However, ByteDance isn’t pioneering this path. Alibaba unveiled its Zhenwu chip for large-scale AI workloads last month. Baidu already sells chips to external clients and plans to list its chip unit Kunlunxin soon. For Chinese tech firms, U.S. export controls on advanced semiconductors have accelerated the push toward domestic alternatives—not just for independence, but for survival in an increasingly constrained supply environment.

ByteDance executive Zhao Qi told employees at a January meeting that AI investment would benefit all company divisions, according to Reuters. Zhao, who oversees Doubao and its international version, Dola, acknowledged the company’s AI models lag behind OpenAI but committed to sustained development funding.

Whether samples actually arrive in March remains uncertain given ByteDance’s denial. The negotiations Reuters describes are reportedly ongoing, and even if a deal closes, scaling from samples to hundreds of thousands of production units typically takes quarters, not weeks.