- Global edtech funding has flattened at low levels, with just $2.77B in 2025 YTD, far below the $14.5B in 2020 and $19.4B in 2021 peaks.

- Investment is consolidating into narrow niches like healthcare training and AI-powered teacher tools, while most traditional edtech models see weak demand and fewer late-stage rounds.

- The future of learning tech is shifting outside edtech, as general AI platforms capture the real momentum.

There's a quiet shift happening in global venture markets, and edtech is sitting on the wrong side of it. Across AI, robotics, biotech, and deep-tech infrastructure, 2025 has produced some of the largest rounds since before the downturn, the 2022–2023 reset that froze late-stage funding and forced valuations across tech to correct. Capital has now returned with conviction. Except in one place. Edtech.

Global funding to edtech-focused startups is just $2.77 billion so far this year. That's essentially flat compared to 2024 and only a fraction of the $14.55 billion recorded in 2020 or the $19.4 billion peak of 2021. The sector hasn't collapsed further, but the plateau is sitting at the bottom of a long slide. The market has stopped falling, but it hasn't started recovering.

Here's one important detail hidden inside that number. Crunchbase counts only companies whose core product is education technology. It doesn't include general-purpose AI tools like ChatGPT, Claude, or even Gemini that millions of teachers and students now rely on every day. If those products were included, the chart would look very different. The stagnation you see here is specific to companies that still define themselves as edtech, hence, limits of the category are becoming visible.

MORE INSIGHTS ON THIS TOPIC:

- How gamers and classrooms are breathing new life into Tablets and Chromebooks

- PC demand in the Philippines' education sector has slowed down—here's why

- Why are AI healthcare and biotech startups pulling in record funding in 2025?

The market’s patience has thinned out

The most revealing comparison sits in the United States. Edtech startups there have raised $1.22 billion so far in 2025, slightly stronger than 2024 and roughly on par with 2023. But even that marginal lift looks subdued against the $8.81 billion raised in 2021.

Investor confidence did not evaporate overnight. It faded over several cycles. Many of the pandemic-era winners struggled to retain users once classrooms reopened. Margins compressed. Churn increased. Growth stalled. The result is visible in the size and structure of deals. Fewer growth-stage rounds. Fewer pre-IPO financings. Almost no large late-stage checks.

The biggest round of the year went to Amboss, a Berlin-based medical learning platform, which raised $260 million. After that, the slope drops quickly. Lingokids raised $120 million. EdSights secured $80 million. MagicSchool AI raised $45 million.

These rounds matter, but they are not the building blocks of a healthy category. They show investors concentrating in narrow pockets where the business model is already validated: medical education, healthcare training, and AI tools that give teachers time back. This isn't what the pandemic playbook imagined.

A shift toward healthcare learning and AI tutoring

When you track where the capital is going, the pattern becomes hard to ignore. The momentum is concentrated in healthcare, medical training, clinical upskilling, and AI-driven instruction tools. These are areas with predictable revenue, low seasonal volatility, and measurable outcomes.

Amboss continues to raise because doctors and medical students are sticky customers. EdSights grows because retention tools solve an immediate institutional need. MagicSchool AI gains traction because teachers adopt tools that reduce administrative load on day one.

The larger vision that once surrounded edtech, an overhaul of how learning works at scale, has faded from the investor narrative. Capital is clustering around specific use-cases where the value proposition is clear and the downside risk is limited.

Outside those niches, the pullback is harsh. Coding academies have lost momentum as AI automates large parts of the curriculum. General learning platforms face stalled user growth. And the pool of late-stage capital that once chased edtech leaders is now chasing frontier AI companies with far stronger scale dynamics.

The exits tell a sharper story than the funding

The M&A activity in 2025 reinforces the same picture. CareAcademy was acquired quietly. OnlineMedEd was absorbed by Archer Review. Modern Campus sold a majority stake to private equity. These are outcomes designed to stabilise companies, not scale them.

There's one exception in India, and it proves the rule. PhysicsWallah, founded in 2020, listed this year at a 33% premium and touched a $5 billion valuation on its opening day. It remains one of the very few profitable edtech companies at scale. The fact that it stands alone in the global IPO landscape only underscores how rare late-stage confidence has become across the category.

Outside of that single listing, edtech IPOs are absent. Public markets have little appetite for companies that depend on slow institutional sales cycles or high acquisition costs.

The optimist case is real, but it depends entirely on AI

There is still a credible bullish argument forming underneath the stagnation. Owl Ventures projects the global education and training market will surpass $10 trillion by 2030. The firm believes AI will shift the economics of learning more than any tool of the past decade.

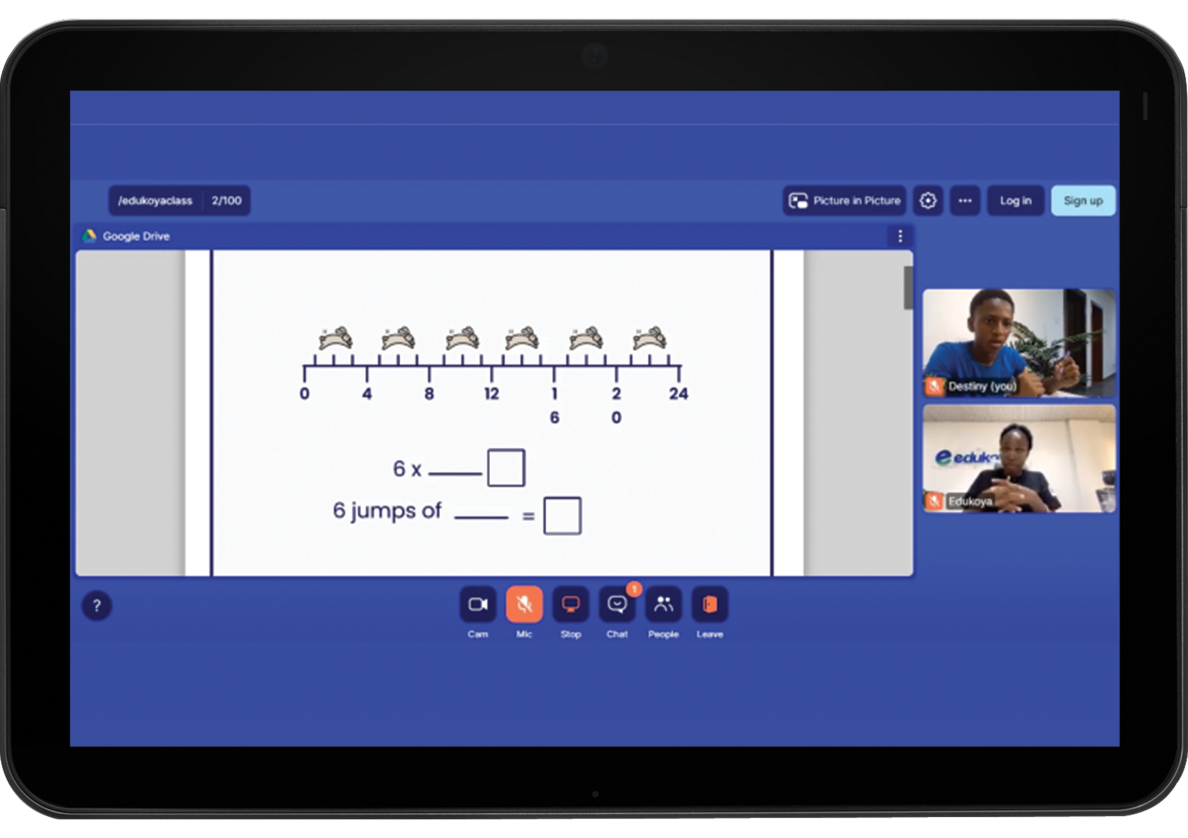

And to be fair, the early signs are visible. Teachers report measurable time savings from AI lesson-planning tools. Students are engaging with personalised tutoring systems previously impossible to scale. Universities and schools are experimenting with adaptive curriculum and AI-driven assessments.

The fundamental challenge is pacing. Venture capital rewards acceleration, not slow structural change. The categories where AI is already unlocking fast revenue growth are enterprise software, productivity, healthcare, and infrastructure. Education is not moving at that velocity yet. And until it does, edtech as a standalone category will lag behind the rest of the market.

The real question for edtech in 2025

The data forces a more nuanced question. Is edtech declining, or is the definition of edtech becoming outdated?

Right now, most of the innovation shaping global learning is being built by AI labs, productivity companies, and multi-purpose platforms that do not identify as edtech. The most advanced learning tools sit outside the category entirely. That means edtech risks shrinking into a narrow segment of a much larger transformation that is happening elsewhere.

If funding returns in the next cycle, it will likely flow to companies that treat education as one use-case within a broader AI platform rather than as the core business itself. The standalone edtech category may not be dying, but it is clearly being absorbed by something bigger and faster moving.