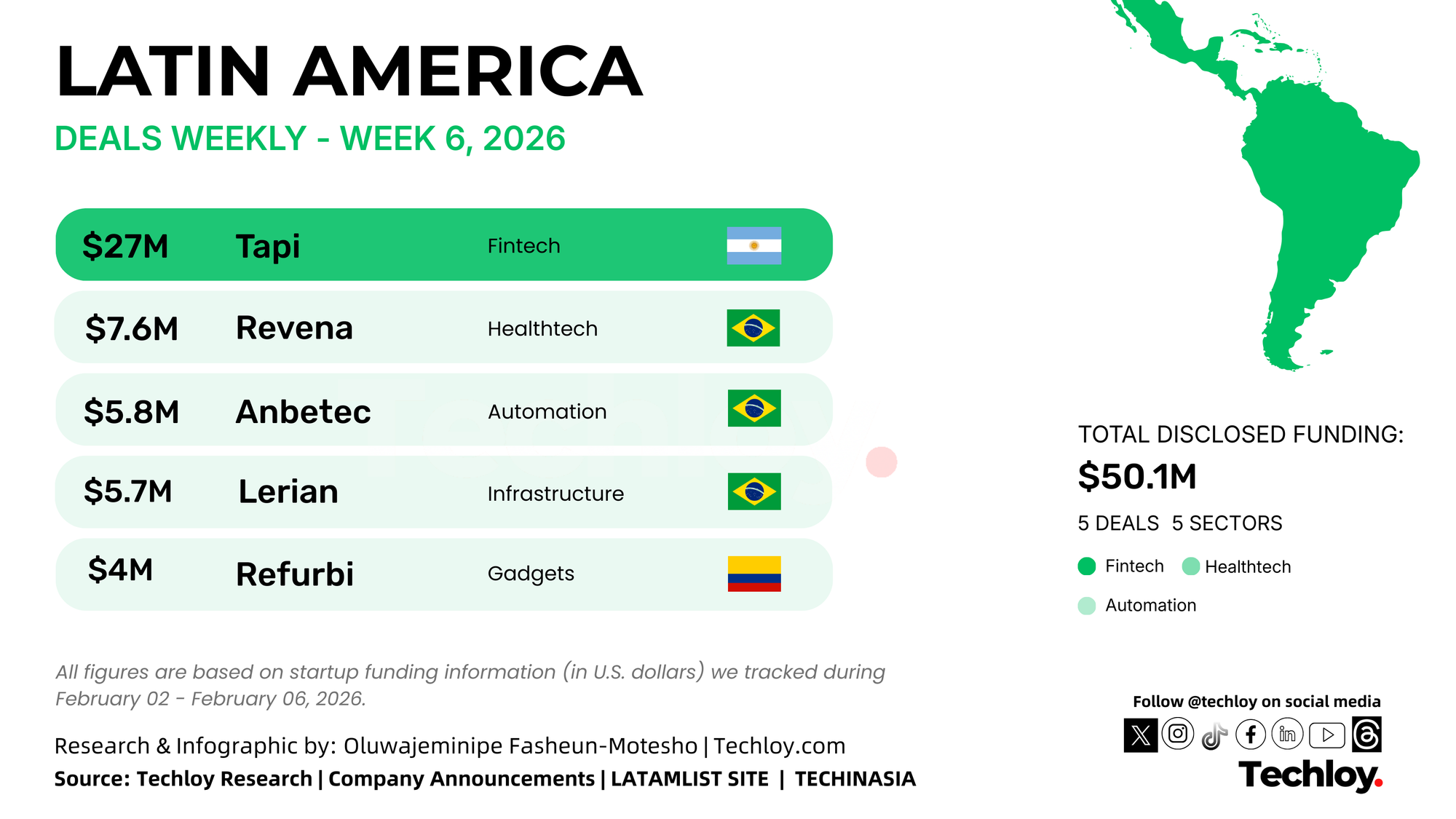

Startups across Latin America raised a combined $50.1 million this week, based on disclosed funding rounds tracked by Techloy, with most investor capital going into fintech and financial infrastructure platforms. A small number of mid-stage and growth deals accounted for the majority of the funding activity.

The Week’s Largest Startup Funding Rounds

Here are the biggest disclosed startup funding rounds across Latin America.

/1. Tapi, $27M, Fintech, Argentina

Argentinian fintech startup Tapi raised $27 million in a Series B round led by Kaszek Ventures, with participation from Endeavor Catalyst and Latitud.

Tapi plans to use the money to expand in Mexico. The company will invest in hiring, new payment services, and possible acquisitions. Mexico already handles about 90% of Tapi’s roughly 25 million monthly transactions. Tapi works with more than 110 clients, including Nubank and MercadoPago. It also partners with retailers to support cash deposits and bill payments.

/2. Revena, $7.6M, Healthtech, Brazil

Revena builds an AI platform that connects to hospital systems and automates medical billing. The platform reads clinical data, interprets payer contracts, and automatically creates medical claims.

The Brazilian startup raised a $7.6 million seed round led by Canary, with participation from Flourish Ventures and Caravela Capital. The funds will be used to grow the product team and expand the platform to cover the full hospital revenue cycle.

/3. Anbetec, $5.8M, Fintech Automation, Brazil

Anbetec is a financial automation platform that connects company back-office data with banking and credit systems. It works with multiple ERP systems and offers tools like credit scoring, crypto processing, and digital order management.

The company raised $5.8 million from SRM Ventures, but the funding stage wasn’t disclosed. Anbetec will use the funding to scale its new embedded credit service and launch digital accounts and cards as part of its financial offering.

4. Lerian, $5.7M, Fintech Infrastructure, Brazil

Lerian builds open-source, cloud-based financial infrastructure. Its main product, Midaz, is an open-source transaction ledger with tools for onboarding, compliance, risk checks, and reporting.

The startup raised a $5.7 million seed round led by MAYA Capital, with participation from Norte Ventures, Supera Capital, Crivo Ventures, Blustone, and Kevin Efrusy. The funds will support platform development, product expansion, and early preparation for international markets.

/5. Refurbi, $4M, Circular Economy, Colombia

Refurbi collects used smartphones, refurbishes them, and resells them through its own marketplace. The company also offers trade-in programs, device software, and optional financing and insurance.

Refurbi raised a $4 million seed round extension in debt and equity. Latin Leap led the equity portion, while the Inter-American Development Bank and Itaú led the debt. The funding will be used to support Refurbi’s expansion into Mexico.

Conclusion

With $50.1 million in disclosed funding this week, investor focus in Latin America remains strongly centered on fintech and financial infrastructure, especially platforms supporting payments, credit, and automation. At the same time, healthtech and circular economy startups continue to attract steady early-stage capital, showing a balanced mix of core financial systems and emerging impact-driven technologies.