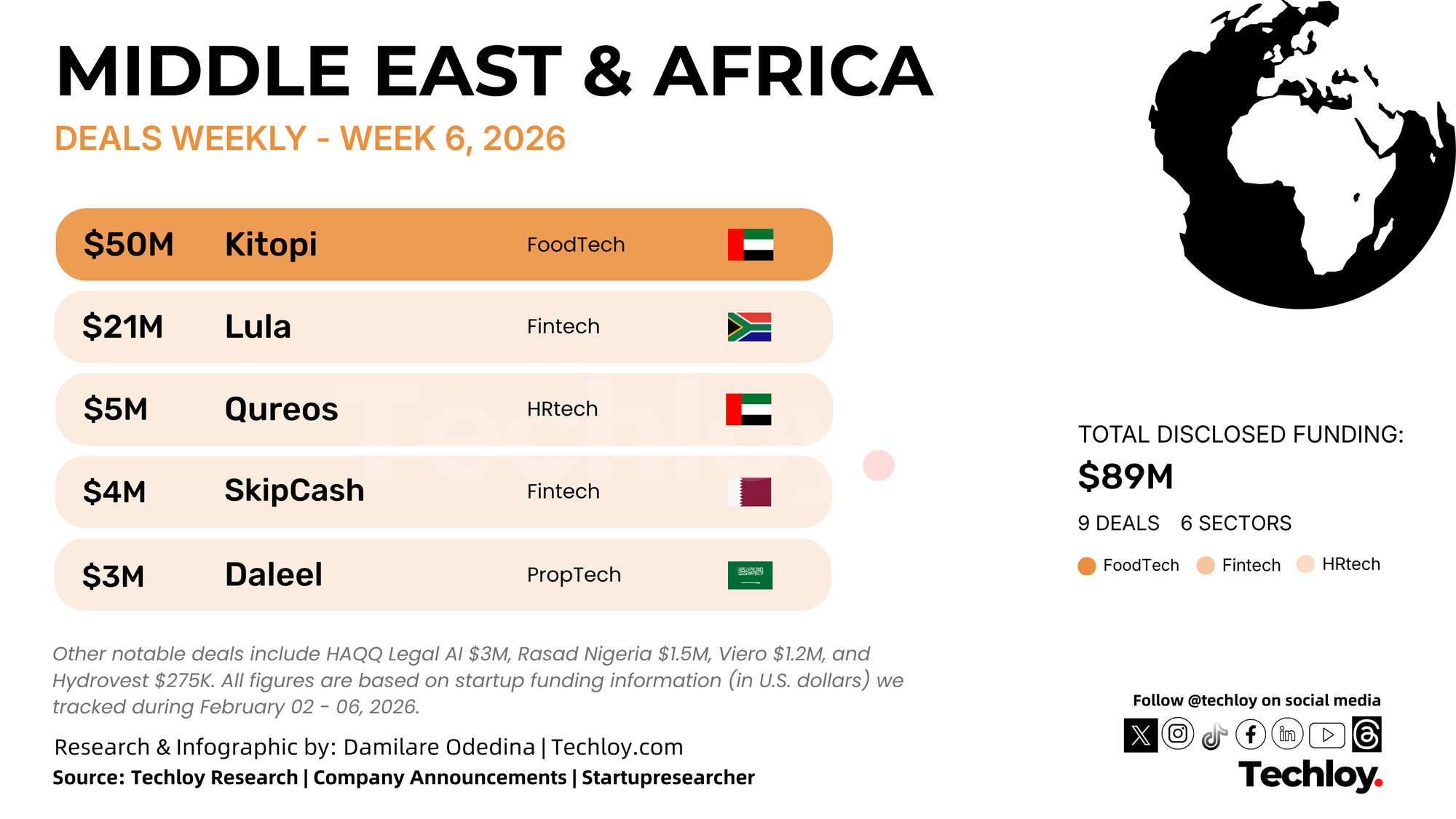

Startups across Africa and the Middle East raised a combined $89 million this week, based on disclosed funding rounds tracked by Techloy, with investor capital flowing primarily into food technology, payments, and AI-powered platforms. One large growth-stage deal accounted for most of the week’s funding activity.

The Week’s Largest Startup Funding Rounds

Here are the biggest disclosed startup funding rounds across Africa and the Middle East.

/1. Kitopi, $50M, FoodTech, UAE

Kitopi operates a cloud kitchen network with 200+ outlets across the UAE, Saudi Arabia, Qatar, Bahrain, and Kuwait, serving both delivery and dine-in customers. EvolutionX, the private credit platform by Temasek and DBS Bank, led the growth capital round. The funding expands Kitopi’s homegrown brands (Operation Falafel, Catch-22, Right Bite) across GCC markets and accelerates franchising plans regionally and internationally following the company’s profitability milestone.

/2. Lula, $21M, Fintech, South Africa

Lula operates a digital banking and credit platform for SMEs, using AI to score businesses in minutes rather than weeks. FMO, the Dutch entrepreneurial development bank, provided the R340 million (approx. $21 million) local currency debt facility. The funding expands Lula's loan book to serve the "missing middle" (businesses too big for microfinance but too small for corporate banking) with a specific focus on women-owned enterprises.

/3. Qureos, $5M, HRtech, UAE

Qureos built an AI hiring platform that automates sourcing, screening, and interviewing for companies, cutting hiring timelines from months to six days. Prosus Ventures and Salica Oryx Fund led the seed round, with participation from Oraseya Capital, Plus VC, F6 Ventures, BDev Ventures, Sunny Side Venture Partners, COTU Ventures, Globivest, and Daniel Tyre.

The funding will help develop AI capabilities, grow the sales team, and expand into new markets beyond the current 1,000+ enterprise clients, including Qatar Airways and Dubai Economy and Tourism.

/4. SkipCash, $4M, Fintech, Qatar

SkipCash provides digital and mobile-first payment solutions, including Tap-to-Phone point-of-sale technology across in-store and online commerce in Qatar. Qatar Development Bank, Qatar Islamic Insurance Company, KBN Holding Group, Finjan Venture Investments, Ula Capital, and Doha Tech Angels participated in the Series A round. The funding enhances technology infrastructure, expands deployment of the Tap-to-Phone solution, and enters new GCC markets.

/5. Daleel, $3M, PropTech, Saudi Arabia

Daleel runs an AI-powered real estate platform helping users find, compare, and transact properties in Saudi Arabia. The pre-seed round funds product development, market expansion, and team growth. Investor names were not disclosed.

/6. HAQQ Legal AI, $3M, LegalTech, Lebanon

HAQQ Legal AI provides an AI platform that digitizes and automates legal workflows at scale for law firms and corporate legal departments. The funding will scale the product, expand market reach, and develop additional AI capabilities for legal professionals across MENA.

/7. Rasad Nigeria, $1.5M, Agritech, Nigeria

Rasad Nigeria provides technology services for farmers, including access to inputs, market linkages, and financial tools. Sahel Capital provided the $1.5 million loan to expand operations and serve more farming communities across Nigeria.

/8. Viero, $1.2M, Logistics/Fintech, Saudi Arabia

Viero built a fintech operating layer for logistics companies, providing payment infrastructure and financial tools for the logistics sector. The seed round funds product development and market expansion across the UAE and regional logistics networks.

/9. Hydrovest, $275K, Agritech, Qatar

Hydrovest operates agricultural technology focused on hydroponic farming solutions in Qatar. The funding supports commercial expansion and deployment of hydroponic systems addressing food security challenges in the Gulf.

Conclusion

With ~$89 million in disclosed funding this week, investor money in Africa and the Middle East went primarily to food technology and SME financing, with Kitopi’s $50 million growth round accounting for 56% of total capital deployed. Early-stage rounds across AI, logistics, and agritech stayed smaller compared to the massive debt and growth capital flowing into Kitopi and Lula.