Cryptocurrency is no longer a small experiment. It is now a global industry shaping finance, policy, and technology. Across regions, governments are adjusting rules, companies are building new products, and millions of people are using digital assets in daily life. Two regions stand out in this conversation: Asia and America.

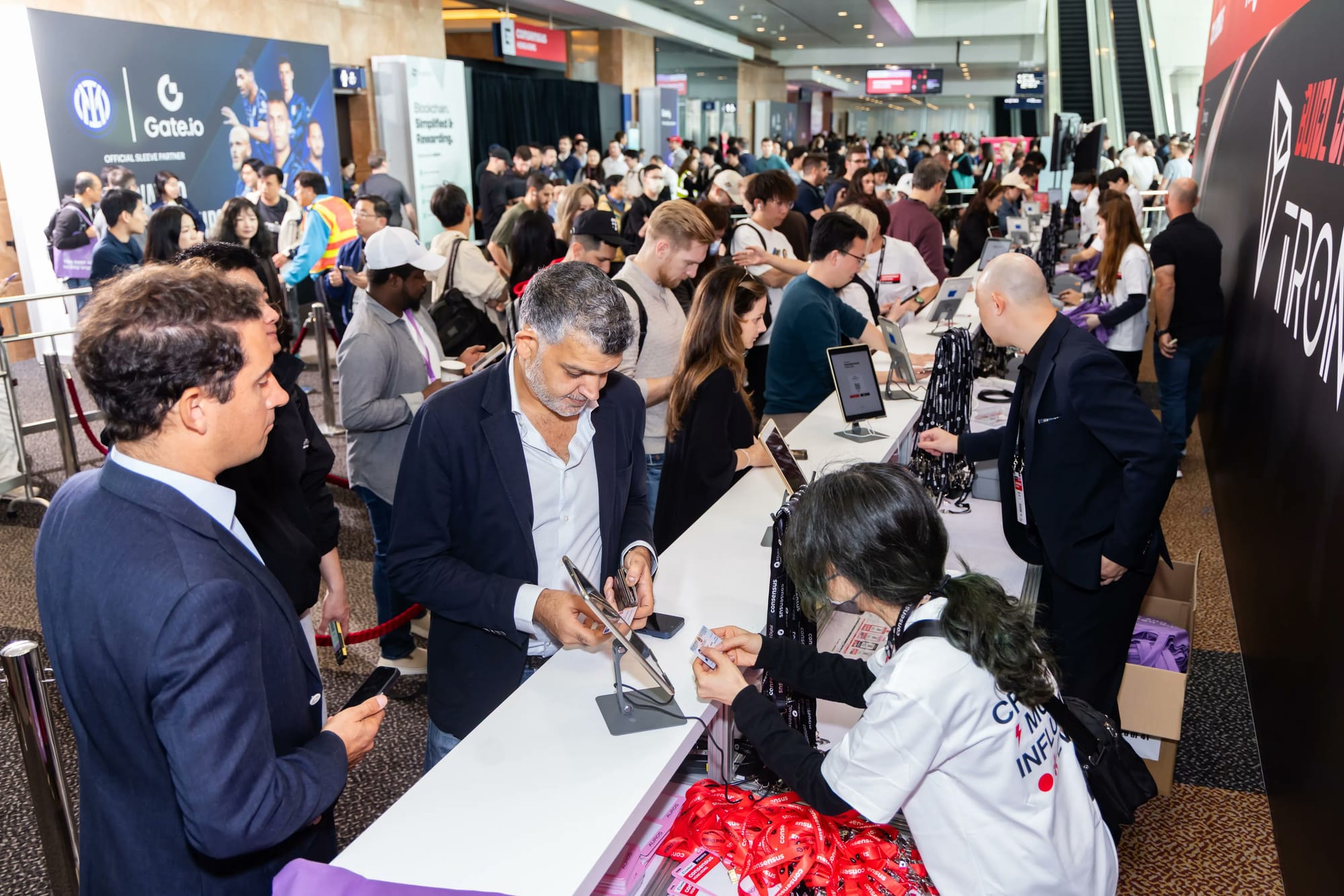

The question is not just who is bigger, but who is moving faster, who is building smarter, and who is shaping the future of crypto. At Consensus Hong Kong 2026, the global blockchain event organised by CoinDesk, the adoption race between the two continents was a focal point.

Hong Kong’s Strategic Advantage and Speed

At Consensus Hong Kong 2026, speakers repeatedly highlighted how quickly parts of Asia are moving, especially Hong Kong. Michael Lau, Chairman of Consensus and SVP at Bullish, pointed to strong government support as a major reason for this speed. He said, “The amount of support that we got from the government... I think it's pretty incredible that after a couple of years we're not talking about how cities... are thinking about digital assets... to have the most senior ranking official to provide official words to kick off... to say ‘hey look we're open for business.’”

His statement reflects something important. In Hong Kong, digital assets are not treated as a side topic. They are treated as a strategic industry. Lau also noted, “If you didn't know this, last year, Hong Kong actually was the number one ranked IPO market globally.”

That context matters. It shows that Hong Kong is not only supportive of crypto but also strong in broader capital markets. That combination gives it speed and flexibility that larger and more bureaucratic regions may struggle to match.

The U.S. Still Drives Global Regulatory Direction

While Asia shows speed and user growth, the United States still holds enormous influence over global regulation. At Consensus Hong Kong 2026, several speakers made it clear that U.S. policy decisions shape conversations worldwide.

David LaValle, President of Indices and Data at CoinDesk, explained this dynamic clearly. He said, “There's been a tremendous amount of regulatory advancement in a lot of the world, and regulatory jurisdictions around the globe look back to the U.S. market... that was really dominating the conversation: this convergence of crypto coming together with TradFi... which is driving regulatory clarity around the globe.”

His words suggest that even when Asia moves fast, global regulators still look to the U.S. for signals. The Clarity Act and the Genius Act in the United States were discussed as major policy developments that influence other countries.

Nick See Tong, APAC Lead at Base, reinforced this point. He said, “Asia is a fast follower, both in terms of the products we build and the regulations we implement. The Clarity Act and the Genius Act in the US are providing local governments here with significant impetus to advance their own regulatory clarity... we are seeing local stablecoin companies and issuers becoming much more active.”

Stablecoins, Yield, and a Regulatory Impasse

Another major topic at Consensus Hong Kong 2026 was stablecoins and the tension between crypto firms and traditional banks. Nikhilesh De, Managing Editor for Global Policy and Regulation at CoinDesk, explained that progress remains complicated. He said, “The big takeaway is that while negotiations continue, crypto companies and the banking industry remain at an impasse... banks are unwilling to compromise on stablecoin yield concerns.”

This issue centers around whether stablecoin companies can offer yield or rewards to users. It is not a small debate. It affects how attractive stablecoins are compared to traditional bank deposits.

When asked whether the U.S. is at a disadvantage compared to Hong Kong, De responded, “I don't think [the U.S. is at a disadvantage]... US stablecoin companies are doing fine. However, Hong Kong is focusing on local currency stablecoins. It will be fascinating to see how these local ecosystems develop independently, regardless of what's happening with the US regulatory framework.”

This highlights a new angle. Instead of simply copying the U.S., parts of Asia may build localized ecosystems, including stablecoins tied to local currencies. That could create parallel systems that operate independently from U.S. policy debates.

Asia’s Historical Role in Crypto

Another strong statement at Consensus Hong Kong 2026 came from Lily Liu, President of the Solana Foundation. She said, “Asia underpinned Bitcoin at any aspect. The most successful blockchain organizations have come from APAC.”

Her comment points to something deeper than regulation or transaction volume. Asia has historically played a key role in mining, trading, developer communities, and exchange growth. Even if many global crypto brands appear American, much of the infrastructure and early momentum came from Asia-Pacific.

The political environment in the United States is also shifting. Anthony Scaramucci, Founder of SkyBridge Capital, described President Donald Trump as “the crypto President,” even while noting his own mixed feelings. He said, “I’m not a fan but Donald Trump is the crypto President... Libertarians might not like the bill, but the bill can’t be perfect immediately. The bill has to be in place, and soon there will be amendments to it eventually.”

This underscores how crypto is becoming deeply tied to U.S. politics. Legislation may not be perfect at first, but it signals a shift toward clearer federal frameworks.