If you own crypto or plan to buy some, one of the first decisions you will face is where to store it. This is where hot wallets and cold wallets come in. Both are widely used across the global crypto market, from everyday users holding small amounts to long term investors protecting large portfolios. As crypto adoption grows in regions like Africa, Asia, and Europe, wallet security has become even more important. Hacks, scams, and lost funds are still common, and the type of wallet you choose can make a big difference.

A hot wallet is a crypto wallet that is connected to the internet. It usually comes as a mobile app, desktop app, or web wallet. Examples include Trust Wallet, MetaMask, and exchange wallets like Binance Wallet. Hot wallets are designed for easy access and quick transactions, making them popular for daily trading and payments.

A cold wallet, on the other hand, stores crypto offline. It is usually a hardware device or even a paper wallet. Because it is not connected to the internet, it is harder for hackers to access. Cold wallets are commonly used by people who want to store crypto for a long time without frequent transactions.

In this article, we compare hot wallets and cold wallets to explain which one keeps your crypto safer.

/1. How They Work

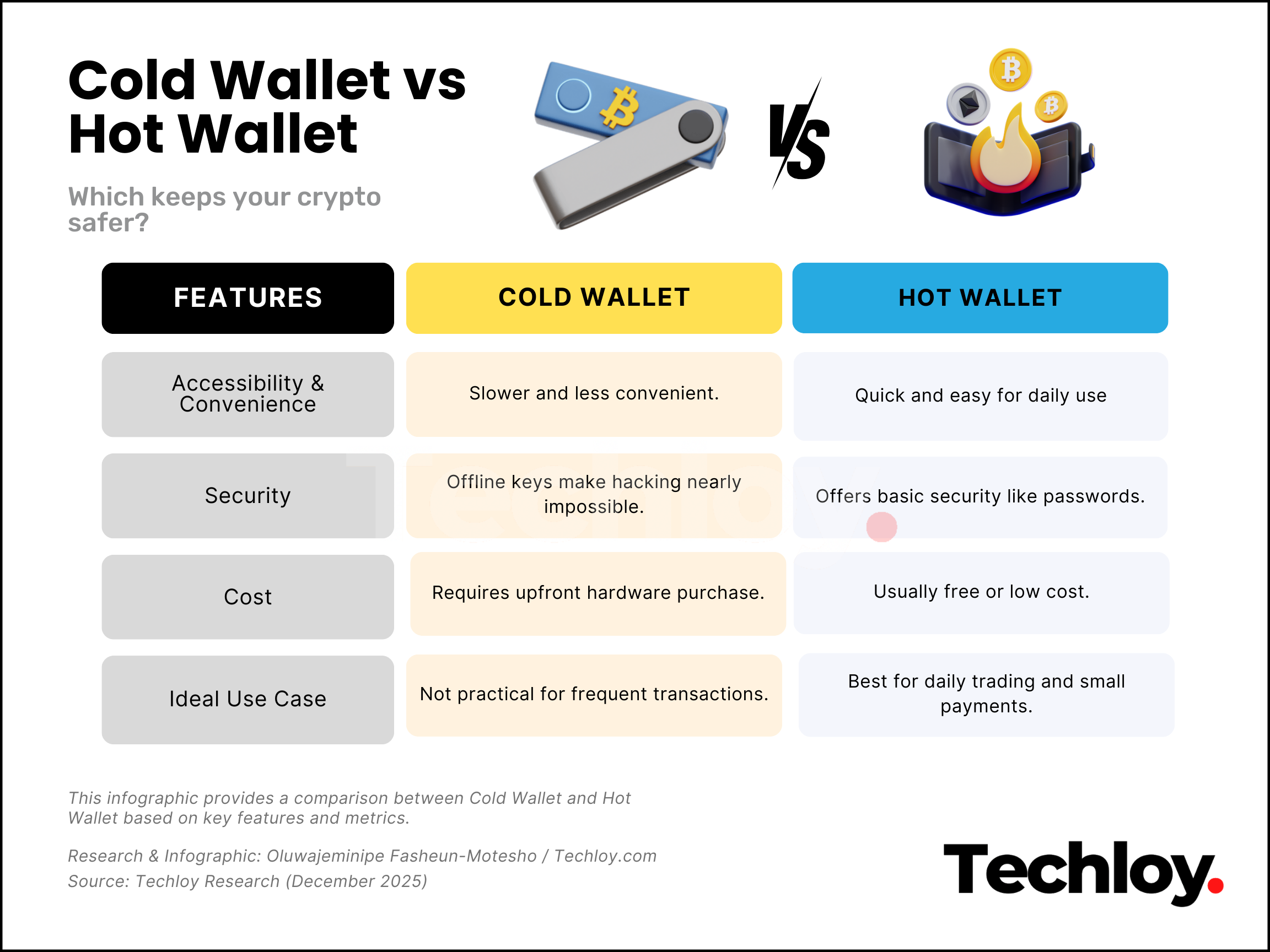

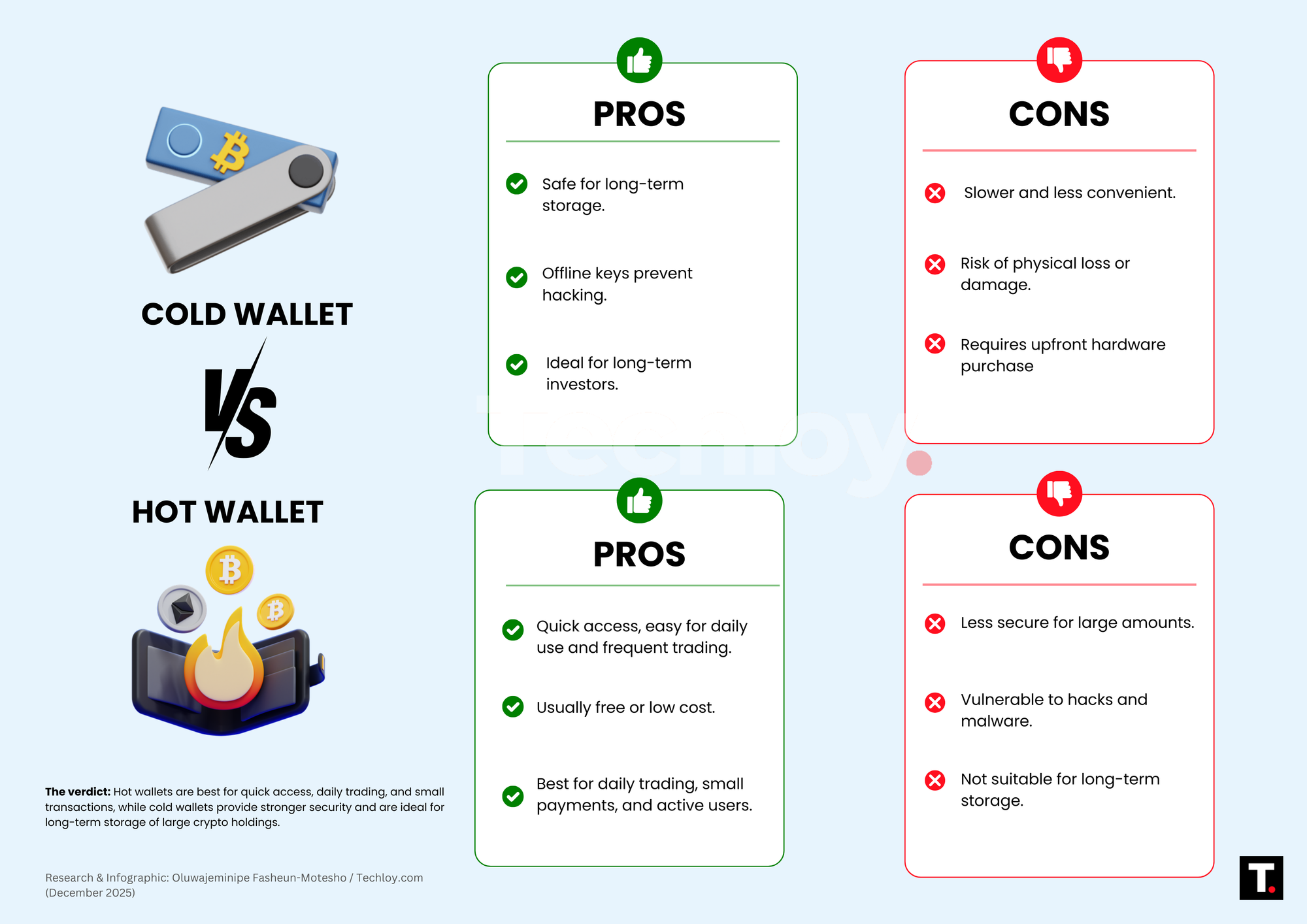

Hot wallets work by keeping your private keys on a device that is connected to the internet. This allows you to send, receive, and manage crypto quickly. However, being online also exposes hot wallets to risks like hacking, phishing, and malware.

Cold wallets work by keeping private keys completely offline. Transactions are signed offline and only then broadcast online. This extra step reduces risk but also makes the process slower and less convenient.

/2. Security and Risk

Hot wallets are more vulnerable to cyber attacks because they are always online. If your device is compromised or you fall for a scam, your funds can be stolen quickly. Many hot wallets add security features like passwords and biometrics, but the risk is still higher.

Cold wallets are much safer from online attacks. Since hackers cannot reach them through the internet, stealing funds is far more difficult. The main risk comes from physical loss, damage, or forgetting recovery phrases.

/3. Ease of Use and Accessibility

Hot wallets are very easy to use. They are ideal for beginners and for people who trade often. You can access your funds anytime using your phone or computer, which makes them practical for daily use.

Cold wallets are less convenient. They require extra steps to access funds and are not ideal for frequent transactions. They are better suited for users who do not need constant access to their crypto.

/4. Cost and Use Cases

Most hot wallets are free to use, aside from transaction fees. This makes them attractive for new users or people with small crypto balances. Cold wallets usually cost money because you have to buy a hardware device.

Cold wallets are best for investors holding large amounts or planning to store crypto for years. Hot wallets are better for traders, creators, and anyone making regular transactions.

Conclusion

Hot wallets and cold wallets serve different purposes in the crypto world. Hot wallets are connected to the internet and make it easy to trade, send, and receive crypto quickly. They are simple to use and free, but they come with higher security risks. Cold wallets keep crypto offline, making them much harder to hack, but they are less convenient and usually cost money.

Overall, cold wallets keep your crypto safer, especially if you are holding a large amount or investing long term. Hot wallets are still useful for everyday transactions and small balances. For many users, the best approach is to use both, keeping spending crypto in a hot wallet and savings in a cold wallet.