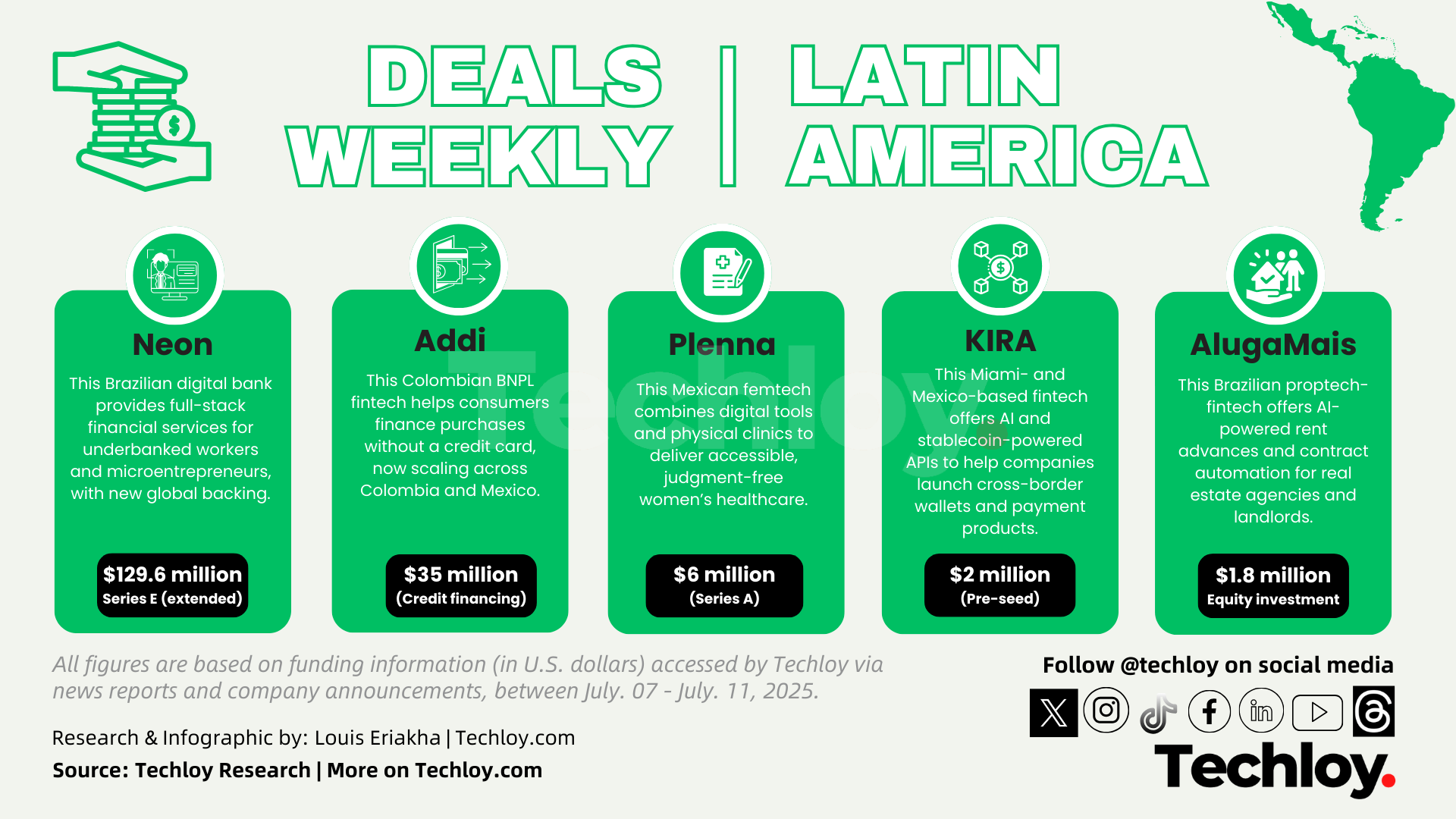

INFOGRAPHIC: LATAM's Top Weekly Startup Funding—Week 28, 2025

In this week's funding deals, we tracked Neon, Addi, Plenna, KIRA and AlugaMais in the LatAm region.

Fintech, femtech, and proptech startups across Latin America raised more than $170 million this week, led by Brazilian digital bank Neon’s expanded Series E round. From credit access and health infrastructure to rent advances and programmable payments, the region’s innovators are blending AI, stablecoins, and financial services to scale impact and investor confidence.

Brazilian fintech Neon led the week by expanding its Series E round to $129.6 million, with new backing from IFC and DEG, alongside existing investors BBVA and General Atlantic. The deal comes as Neon posted a $1.67 million profit in Q1, reversing a steep loss from the previous year. With 32 million customers and a $1.08 billion credit portfolio, Neon plans to grow its private payroll loans, deepen Open Finance integration, and deploy AI to support responsible lending to Brazil’s working class.

Colombian BNPL startup Addi followed with a $35 million credit financing agreement from BBVA Spark, adding to its $270 million in existing facilities from Goldman Sachs, Fasanara Capital, and Victory Park. Founded in 2018, Addi has issued over 19 million loans and works with more than 25,000 businesses, helping consumers finance purchases without a credit card. The new funding will accelerate its growth in Colombia and Mexico as it targets profitability.

Mexican femtech Plenna secured a $6 million Series A led by Mazapil, Dalus Capital, and New Ventures, with support from angel investor Karla Berman. Plenna offers hybrid healthcare through clinics and a digital platform, focusing on personalized, stigma-free services for women aged 27–35. With the funding, the startup will open 13 new clinics across five cities and expand its AI-powered platform to reach more than 200,000 women.

KIRA, based in Miami and Mexico, emerged from stealth with a $2 million pre-seed round, having already generated $3 million in revenue. Its AI and stablecoin-powered infrastructure helps companies launch global financial products—like wallets and cross-border payments—via a unified API. With clients including Banco Industrial and a major global retailer, KIRA is expanding into Colombia and aims to be the infrastructure layer for next-gen fintech.

Rounding out the week, in Brazil, real estate fintech AlugaMais raised $1.8 million from SRM Ventures to grow its rent-advance and credit services. The platform uses AI to automate rental contracts and allows landlords to receive up to 12 months of rent upfront. AlugaMais processes more than R$60 million ($10.8 million) annually and plans to advance R$40 million ($7.2 million) in receivables over the next 12 months.

From BNPL and programmable wallets to AI-driven property management and women’s health access, Latin America’s innovators are blending financial technology with local needs—and investors are taking notice. With digital infrastructure maturing and new capital flowing in, the region’s tech landscape is proving both resilient and ready to scale.