Introducing Pesabase: Revolutionizing Money Transfers to South Sudan

Because sending money to South Sudan often involves high fees, slow transaction times, and limited access to financial services.

In today’s interconnected world, remittances are a crucial lifeline, connecting families and supporting communities across borders. Yet, sending money to South Sudan often involves many challenges, including high fees, slow transaction times, and limited access to financial services.

Enter Pesabase, a blockchain-based remittance platform with local operations in South Sudan, set to transform the way money is sent and received, offering a seamless solution to these enduring issues.

Users can download the Pesabase app, which is currently undergoing an upgrade, with a new version scheduled for release in June 2024. While users send money via local agents in Juba, the upgrade will enable direct transfers to designated recipients.

Challenges of Traditional Money Transfers to South Sudan

Traditionally, money transfers to South Sudan have been hampered by inefficient and costly methods. Conventional bank transfers are infamous for their high fees and lengthy processing times, frustrating both senders and recipients. Although money transfer operators (MTOs) offer quicker transactions, they often come with exorbitant fees, further straining those sending remittances.

Additionally, an underdeveloped financial infrastructure presents further obstacles to South Sudan investors, with limited access to banking services and a reliance on cash-based transactions. This lack of formal financial systems not only complicates remittances but also heightens the risk of fraud and theft, compromising transaction security.

How Pesabase Overcomes Common Challenges

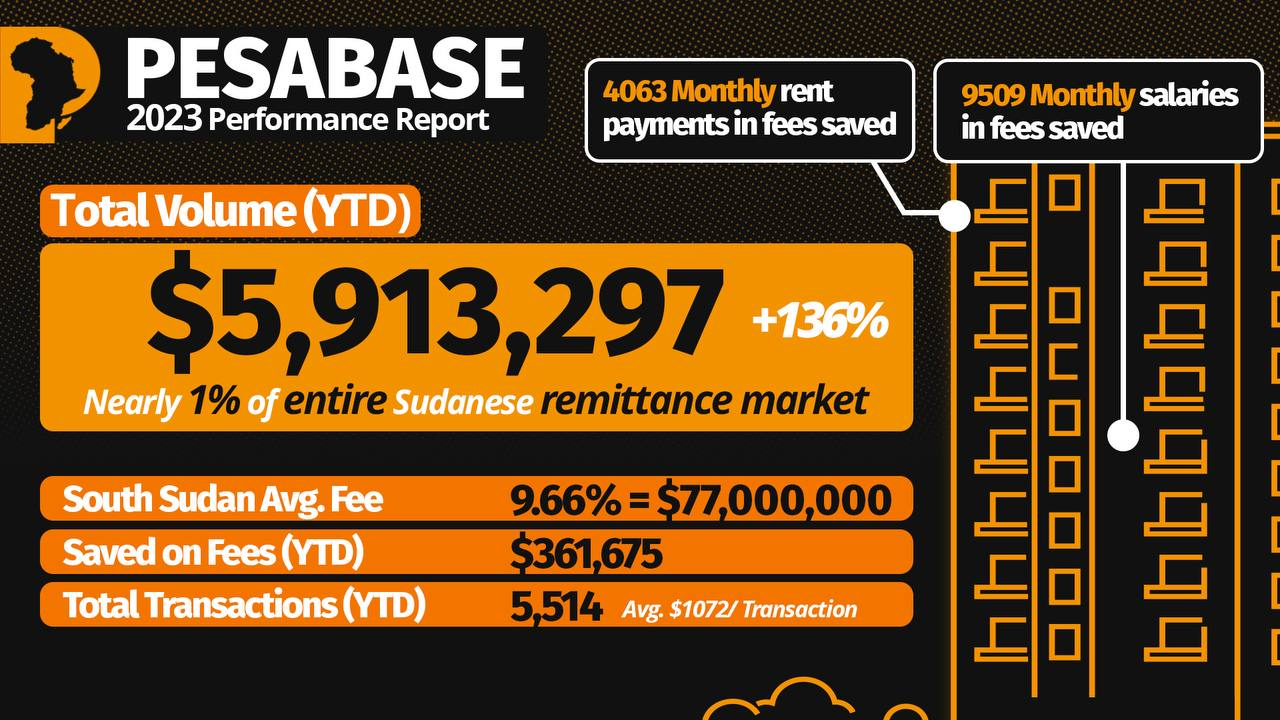

1. High Fees: Pesabase offers competitive transaction fees, significantly lower than those charged by traditional remittance channels (1.5% vs standard 9%). This allows senders to maximize the amount sent to their loved ones, reducing the financial burden on both parties. By minimizing fees, Pesabase makes it more affordable for people to support their families in South Sudan.

2. Slow Transaction Times: Utilizing blockchain technology, Pesabase ensures swift processing of transactions. This technology allows for near-instantaneous transfers, enabling recipients to access funds promptly, even in remote areas with limited banking infrastructure. Faster transactions mean that families can receive much-needed funds in real-time, enhancing their financial stability.

3. Limited Access to Financial Services: Through its local operations, Pesabase expands access to financial services in South Sudan. By providing more people with access to banking and financial services, Pesabase empowers individuals and communities to participate more actively in the economy. This increased access can lead to greater financial inclusion and economic development in the region.

4. Lack of Transparency: Pesabase provides real-time tracking of transactions, giving users full visibility into the status of their remittances. This transparency ensures that both senders and recipients can monitor the progress of their transactions, fostering trust and reliability in the remittance process. Users can feel confident that their money is safe and will reach its intended destination.

Unique Localized Approach of Pesabase

What sets Pesabase apart is its localized approach to remittance services in South Sudan. With a presence on the ground, Pesabase is uniquely positioned to understand and address the specific needs of the local population. This local operation enhances access to financial services and fosters community trust and engagement.

By establishing local partnerships and working closely with the community, Pesabase can tailor its services to better meet the needs of South Sudanese residents. This approach not only facilitates better accessibility to financial services but also creates a sense of ownership and trust within the community. Pesabase’s local presence ensures that it remains attuned to the unique challenges and opportunities in the region, enabling it to provide more effective and relevant solutions.

Benefits for Token Investors

Beyond transforming remittance services, Pesabase offers a compelling opportunity for token investors to participate in and benefit from the platform’s growth and success. Here’s how:

Token Value Appreciation

As Pesabase gains traction and expands its user base, the demand for its native tokens is likely to increase. This heightened demand will drive up the value of the tokens, potentially leading to capital appreciation for early investors. By investing early, token holders can benefit from the platform’s growth and increasing user base.

Utility Within the Platform

Pesabase tokens serve as the primary medium of exchange within the platform’s ecosystem. As more users transact through Pesabase, the utility and demand for its tokens are expected to rise. This creates a positive feedback loop that benefits token holders, as increased usage drives token value and utility.

Revenue Sharing

Pesabase implements mechanisms whereby token holders receive a share of the platform’s revenue. This occurs through buybacks, where tokens are burned to reduce supply, increasing the value of the remaining tokens based on the platform’s performance. This revenue-sharing model provides token holders with a tangible return on their investment.

Early Access to Features and Benefits

Token investors may receive early access to new features, products, or services launched by Pesabase. This exclusive access not only enhances their experience but also provides an incentive for early adoption and engagement. Early adopters can take advantage of new opportunities and innovations as they are introduced.

Diversification and Portfolio Growth

Investing in Pesabase tokens offers investors an opportunity to diversify their portfolios by gaining exposure to the burgeoning blockchain and fintech sectors. As Pesabase continues to innovate and disrupt traditional remittance models, investors stand to benefit from the platform’s growth and the diversification of their investment portfolios. This diversification can help mitigate risk and enhance overall portfolio performance.