Brazilian agro-fintech Nagro raises $49 million to make credit accessible to rural farmers

Brazil, a global agricultural powerhouse feeding about 800 million people worldwide according to the Brazilian Agricultural Research Corporation (EMBRAPA), relies heavily on its agribusiness sector, contributing a substantial 20% to the nation's GDP. Understanding the essentiality of credit to the growth of the agricultural industry, Brazilian agro-fintech Nagro

Brazil, a global agricultural powerhouse feeding about 800 million people worldwide according to the Brazilian Agricultural Research Corporation (EMBRAPA), relies heavily on its agribusiness sector, contributing a substantial 20% to the nation's GDP.

Understanding the essentiality of credit to the growth of the agricultural industry, Brazilian agro-fintech Nagro has secured an impressive $49 million in equity and debt financing to make credit accessible to rural farmers and producers. The funding round saw participation from Kinea Ventures and Revolution, a fund managed by Oasis Ventures.

Nagro has set its sights on two key verticals to utilize this capital infusion effectively: enhancing its credit analysis and risk monitoring capabilities through its innovative platform Agrisk, and expanding its fully digital credit allocation services.

Notably, Nagro has already provided more than $60 million in credit to over 5,000 agricultural businesses. It has also analysed more than 500,000 agribusinesses through its platform, leading to a remarkable 26% reduction in defaulted loans for companies involved in financing the agricultural sector.

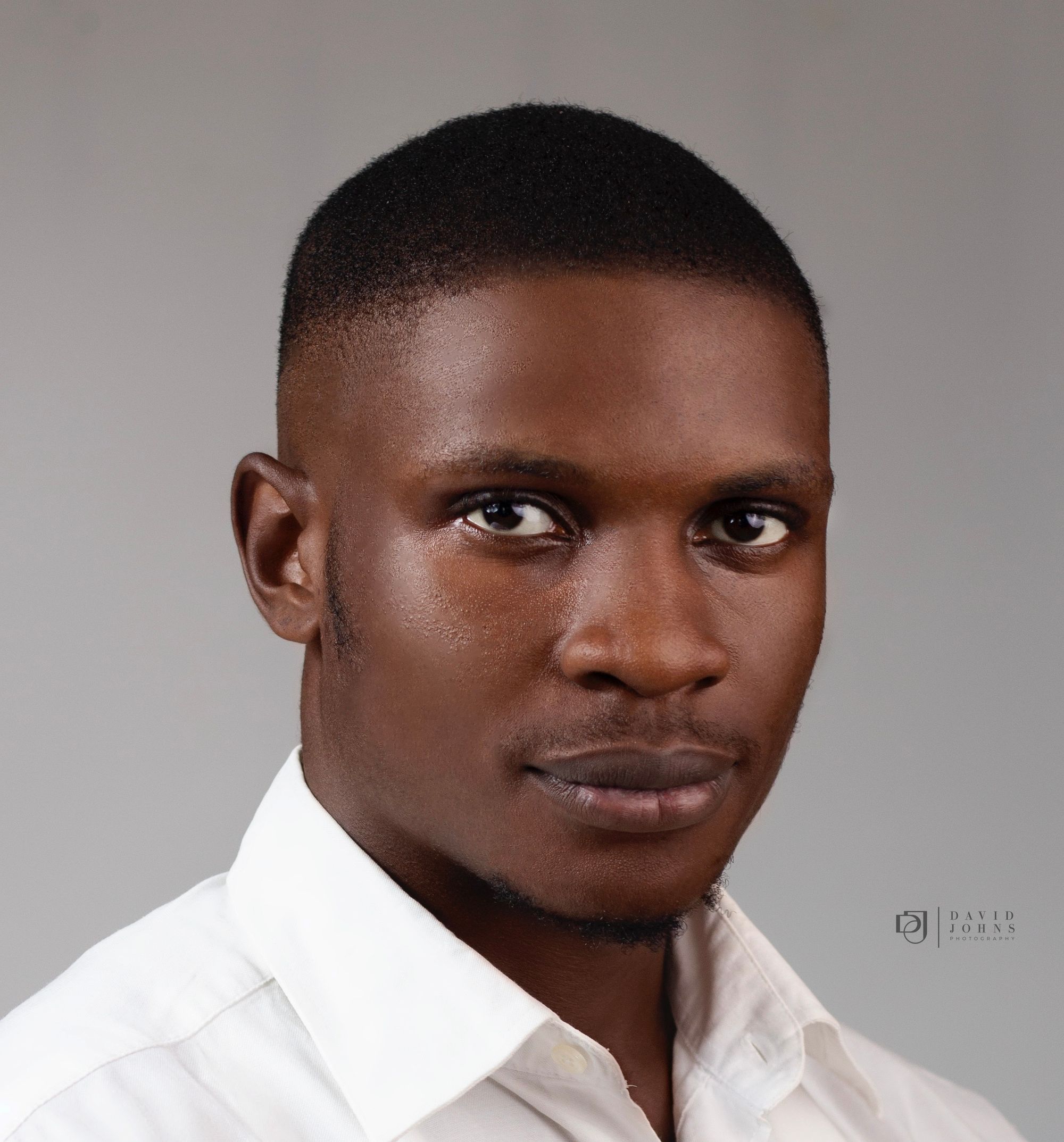

Founded in 2017 by a diverse team led by agronomist and rural producer Gustavo Alves, Nagro is on a trajectory to reach an ambitious target: aiding over 10,000 rural producers by 2024.

With this substantial funding in hand, Nagro is poised to make a significant impact on Brazil's agribusiness landscape, fostering growth and sustainability in the country's sector.