African Fintech Nomba Secures $30M in Series B, backed by Base10 Partners and Shopify

Nigerian payment service provider Nomba has raised $30 million in a pre-Series B investment to support the delivery of effective payment solutions for African businesses. The oversubscribed equity funding round which values the company at $150 million+, according to YCombinator was led by San Francisco-based Base10 Partners, with participation from

Nigerian payment service provider Nomba has raised $30 million in a pre-Series B investment to support the delivery of effective payment solutions for African businesses.

The oversubscribed equity funding round which values the company at $150 million+, according to YCombinator was led by San Francisco-based Base10 Partners, with participation from existing investors Partech, and Khosla Ventures as well as new backers like Helios Digital Ventures, and Shopify.

Prior to this, Nomba raised $5 million in a Series A round in 2019 to grow the business and efficiently deliver solutions that have positively impacted hundreds of thousands of businesses across Nigeria.

Nomba, formerly known as Kudi, is a Nigerian fintech company that was founded in 2016 by Adeyinka Adewale and Pelumi Aboluwarin. Initially, the company launched a chatbot integration that allowed users to make financial requests on social apps. However, it struggled to attain massive scale in Nigeria, where the majority of transactions in the informal economy are still cash-based and many adults remain unbanked.

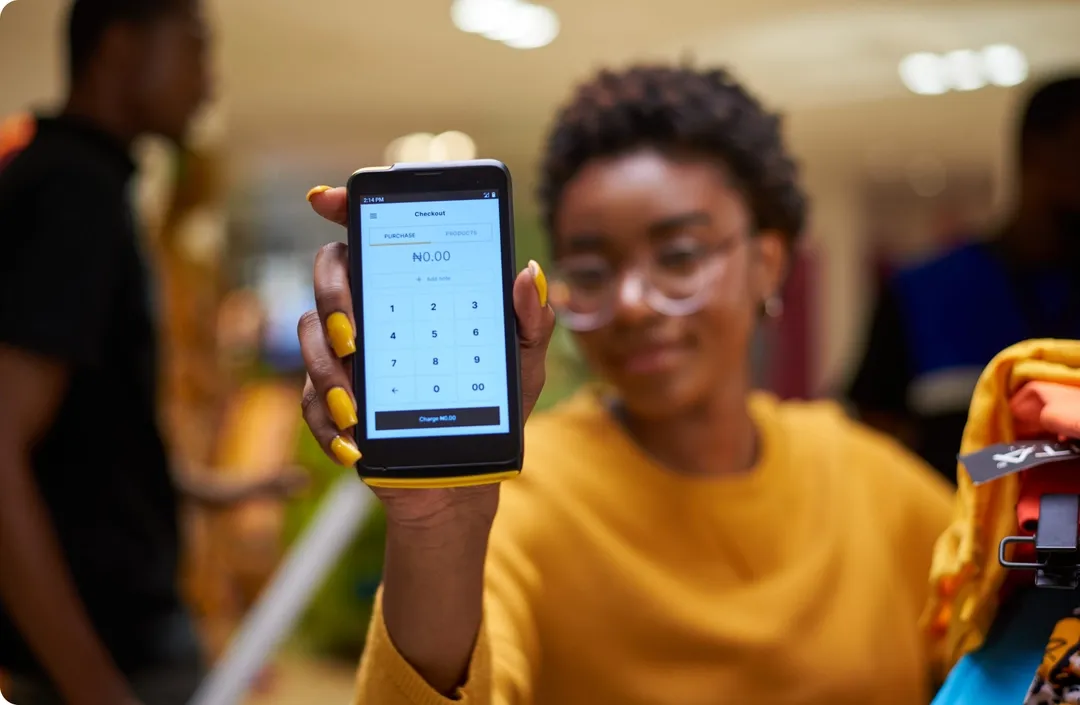

In May 2022, Nomba rebranded and pivoted to an omnichannel platform that offers a wide range of business and management tools such as business savings, joint business savings, card payments, POS terminals, and banking solutions with a portfolio of up to 300,000 different types of businesses.

The company operates on an agency banking model, supplying thousands of individuals and small business owners with POS terminals to offer essential financial services like cash withdrawal, transfer, and bill payments to unbanked and underbanked Nigerians.

Nomba has experienced impressive growth since its pivot, now processing up to $1 billion in monthly transactions and seeing its revenues grow by 150% year-over-year since 2020.