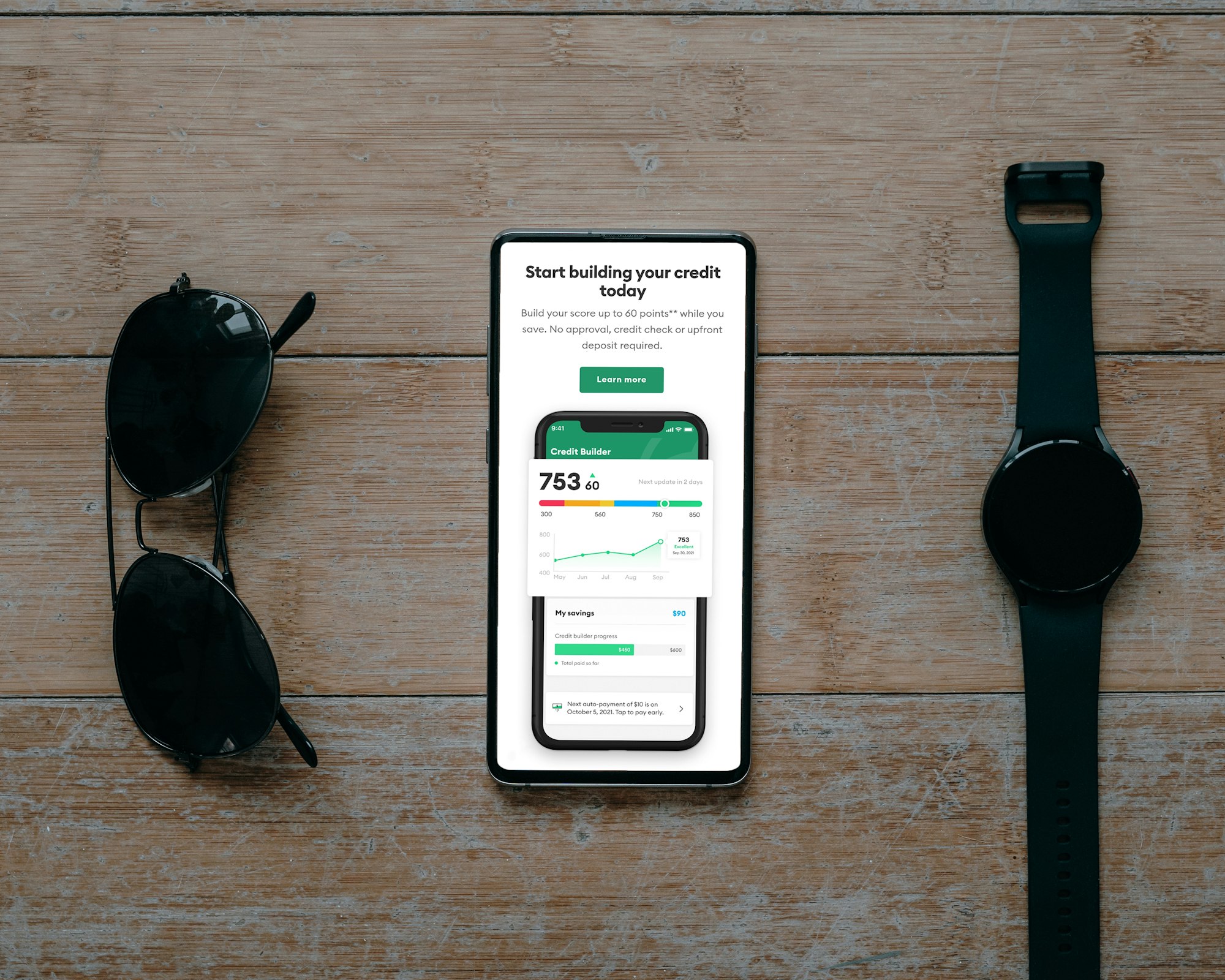

This Filipino fintech startup secured $20 million in debt facility to drive financial inclusion

Filipino fintech startup, Salmon (no, not related to fish) has made a remarkable impact on the lending space in the Philippines, enabling underbanked and unbanked Filipinos to enjoy the convenience of deferring payments and spreading purchase costs over several months. Founded in July 2022, Salmon operates as a platform that

Filipino fintech startup, Salmon (no, not related to fish) has made a remarkable impact on the lending space in the Philippines, enabling underbanked and unbanked Filipinos to enjoy the convenience of deferring payments and spreading purchase costs over several months.

Founded in July 2022, Salmon operates as a platform that offers customers access to financial products from partners registered with the Securities and Exchange Commission (SEC) in the Philippines. Within just four months of its inception, the fintech firm had already launched its first credit product, showcasing its agility and determination.

With 140 staff members at its Manila headquarters, Salmon attracts notable investors, including Abu Dhabi's sovereign wealth fund ADQ and top European venture investors.

Embarking on its mission to promote financial inclusion, Salmon has secured a US$20 million debt facility from US emerging-markets specialist investment firm Argentem Creek Partners.

The substantial funding will play a pivotal role in Salmon's transformative journey, making strides in the fintech landscape, and bringing financial services to a broader segment of the Filipino population. This funding is a major boost for Salmon, allowing it to scale its lending operations nationwide and expand its loan book.