Moniepoint enters the personal banking space to challenge Opay and PalmPay

In a significant stride towards financial inclusion and service diversification, Nigerian fintech company Moniepoint (formally TeamApt) is entering the consumer banking arena to challenge OPay and PalmPay. Founded in 2019, Moniepoint has rapidly become a frontrunner in Nigeria's financial services sector, offering a comprehensive suite of digital financial

In a significant stride towards financial inclusion and service diversification, Nigerian fintech company Moniepoint (formally TeamApt) is entering the consumer banking arena to challenge OPay and PalmPay.

Founded in 2019, Moniepoint has rapidly become a frontrunner in Nigeria's financial services sector, offering a comprehensive suite of digital financial tools including payment, banking, credit, and business management solutions to 600,000+ businesses.

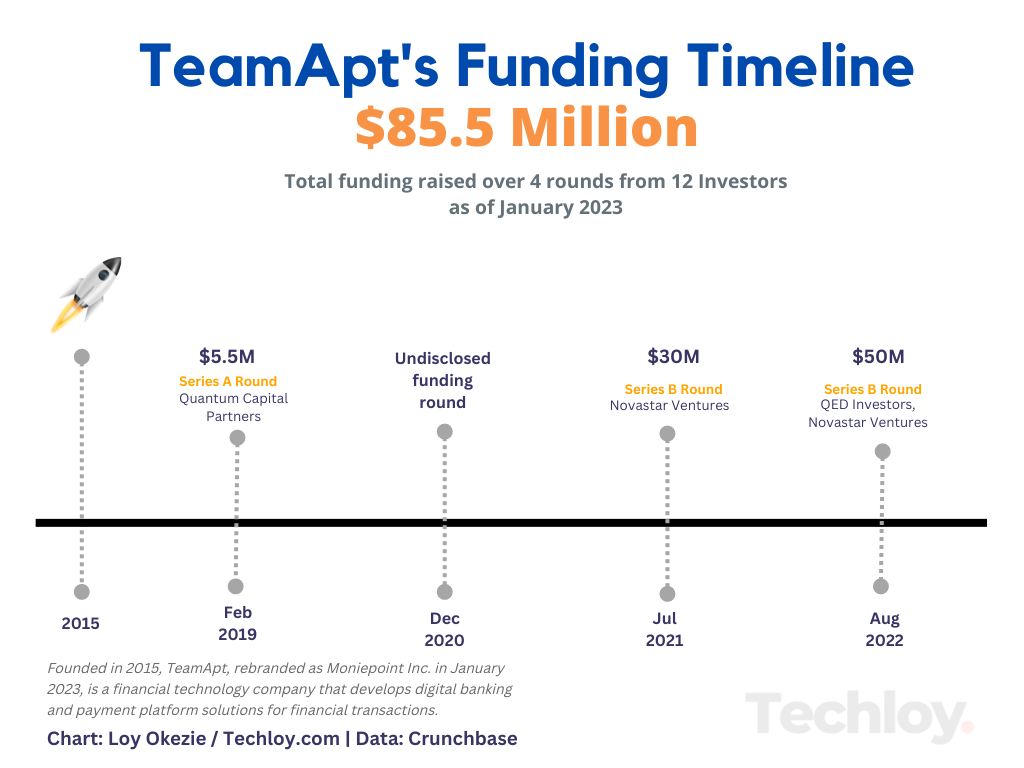

For 2022, the fintech posted an annualized Total Payments Volume (TPV) of over $170 billion and doubled its annual revenues from 2021. It has also raised a total of $85.5 million in funding over 4 rounds since it launched, as the Techloy chart below shows.

However, having only operated a business-facing banking venture, it is extending its formidable reach to serve individual consumers marking a bold expansion of its already substantial footprint.

This new venture is also set to drive its consumer base above the 33 million Nigerians who already use its terminals every month. This massive user base provides a solid foundation for its venture into personal banking.

Its consumer-facing services will bring with them an array of benefits, including a consumer app that will allow users to enjoy the convenience of making transfers, paying bills, and buying airtime, and debit cards which will be issued through global payment processors, including Mastercard and Verve for ATM transactions, point-of-sale terminals, and online transactions.

But while its new venture is undoubtedly ambitious, the path forward is not without its challenges. The fintech finds itself in a pitched battle against established heavyweights like OPay and PalmPay in the fiercely competitive Nigerian consumer banking landscape.

To succeed in this highly contested arena, Moniepoint must prioritize two critical factors in an area where its competitors have already set high standards namely– seamless and lightning-fast transactions and an efficient and effective dispute resolution system for unsuccessful card transactions.