What the Silicon Valley Bank collapse means for startups

A week ago today, Silicon Valley Bank, the 16th biggest bank in the U.S. and a long-time prominent lender in the startup ecosystem collapsed, in what is the largest financial institution collapse in the United States since Washington Mutual went under in 2008. For decades, SVB took deposits from

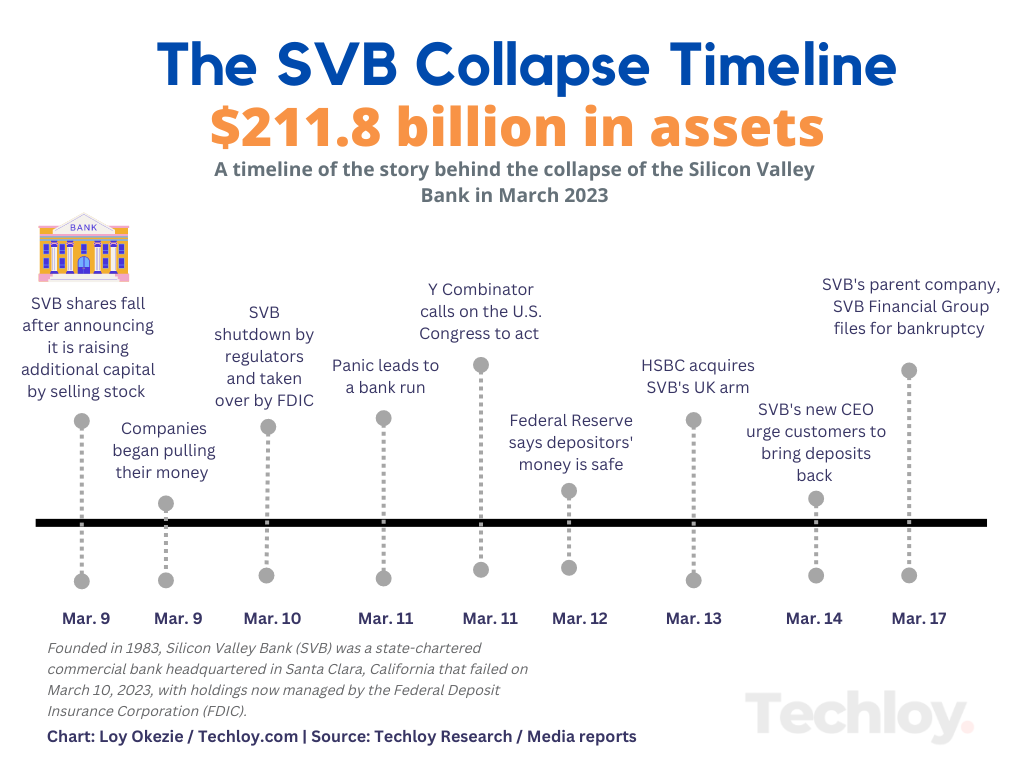

A week ago today, Silicon Valley Bank, the 16th biggest bank in the U.S. and a long-time prominent lender in the startup ecosystem collapsed, in what is the largest financial institution collapse in the United States since Washington Mutual went under in 2008.

For decades, SVB took deposits from clients including high-flying tech startups and invested them in generally safe securities, like bonds. After the Federal Reserve increased interest rates, these bonds that were consistent and secure became worthless.

This wouldn’t have been an issue, but the broader macroeconomic crisis in the venture capital and tech industry caused deposit inflow to slow down, and clients started withdrawing their money.

As a result, SVB was forced to sell part of its bond holdings at a loss of $1.8 billion. This move spooked clients' companies and sent company leaders pulling their money out of the bank frantically which led to a bank run. The bank was eventually taken over by the Federal Deposit Insurance Corporation (FDIC) on Friday.

With up to $175.4 billion in deposits at its last filing, where did the echoes of SVB's collapse reach?

Our lead story in this week's edition of The Draft continues on Techloy.com and the rest of the featured stories, deals, and charts continue below.

– Emmanuel