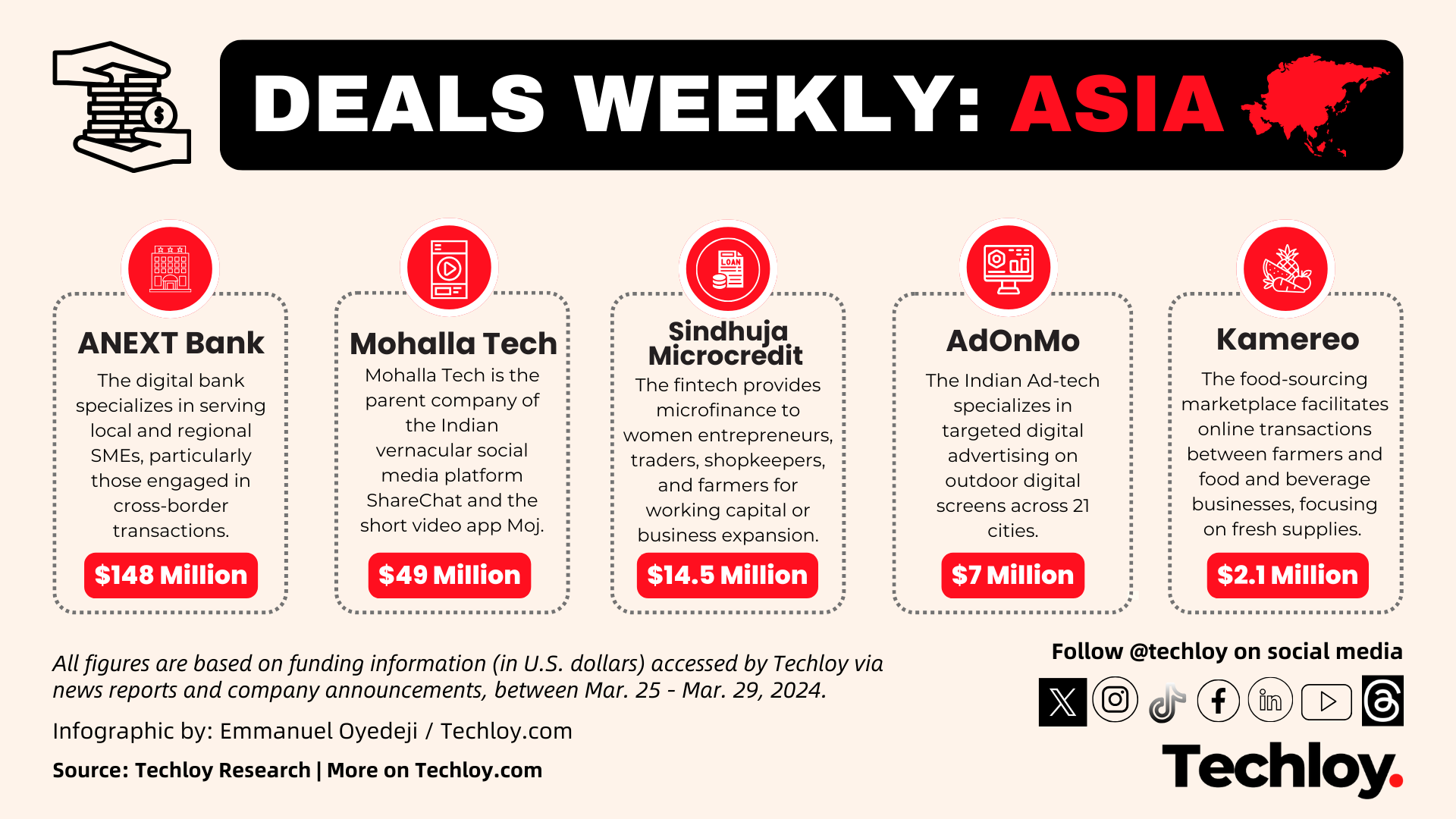

INFOGRAPHIC: Top Asian Startup Funding — Week 13

These are the funding deals we tracked in the Asian region this week – including ANEXT Bank, Mohalla Tech, Subko, Sindhuja Microcredit, SuperK, and Kamereo.

- ANEXT Bank Raises $148 Million from Ant Group for Fintech Advancement

- ShareChat Parent Company, Mohalla Tech Secures $49M in Debt Funding

- Subko Raises $10M to Scale its Speciality Coffee Business

- Sindhuja Microcredit Secures $14.5M in Series C Round

- AdOnMo Secures $7M in Series B1 Round

- SuperK Raises $6M to Expand Tech-Enabled Supermarkets in Rural India

- Kamereo Raises $2.1M to Expand Food-Sourcing Platform

ANEXT Bank Raises $148 Million from Ant Group for Fintech Advancement

- Singapore-based digital bank ANEXT Bank has secured a significant boost of USD 148 million in additional capital from its parent company, Ant Group, according to regulatory filings.

- Established in June 2022 with a digital wholesale bank license from the Monetary Authority of Singapore, ANEXT Bank specializes in serving local and regional small and medium-sized businesses (SMEs), particularly those engaged in cross-border transactions. The bank's mission revolves around accelerating fintech advancement and fostering financial inclusion in Singapore and beyond.

- This recent funding round follows Ant Group's previous investment in March 2023, amounting to USD 188 million, bringing the total investment by Ant Singapore SME Services in ANEXT Bank to over USD 503 million.

ShareChat Parent Company, Mohalla Tech Secures $49M in Debt Funding

- Mohalla Tech, the parent company of the Indian vernacular social media platform ShareChat and short video app Moj, has secured approximately $49 million through convertible debentures from its existing investors including Temasek, Lightspeed, HarbourVest, Moore Strategic, Alkeon Capital, and Tencent.

- The funding comes at a pivotal moment for ShareChat, which faced difficulties attracting new investors and retaining existing ones. It was also seeking $50 million raise at a 1.5 billion valuation, down from a $5 billion peak in June 2022. The company had since implemented cost-cutting measures and underwent two rounds of layoffs in 2023, affecting 700 employees.

- The funding aims to support Mohalla's path to profitability over the next 12 to 15 months. Meanwhile, the startup is currently in discussions with new and existing investors for a larger equity funding round.

Sindhuja Microcredit Secures $14.5M in Series C Round

- Sindhuja Microcredit, a new-generation microfinance firm, has raised $14.5 million (Rs 120 crore) in its Series C funding round from GAWA Capital (via its Huruma Fund) and Oikocredit. This latest funding round follows an $8.7 million Series B in May 2020, and a $4 million Series A in March 2019.

- Co-founded by Abhisheka Kumar and Malkit Singh Didyala, Sindhuja Microcredit specializes in providing microfinance to women entrepreneurs and business loans to traders, shopkeepers, and farmers for working capital or business expansion purposes. Operating for six years, Sindhuja claims to have supported over 400,000 self-employed women micro-entrepreneurs across nine Indian states. Currently, the company operates 235 branches with Assets under Management (AUM) exceeding Rs 10 billion.

- Sindhuja Microcredit plans to utilize the new capital to expand its operations in existing and new regions, as well as to introduce new product lines.

Subko Raises $10M to Scale its Speciality Coffee Business

- Mumbai-based speciality coffee roaster and craft bakehouse Subko has raised $10 million in a funding round led by Zerodha cofounder Nikhil Kamath. Other investors include Blume Founders Fund, and The Gauri Khan Family Trust, among others.

- Subko, which operates through various retail outlets offering speciality coffee, craft baked goods, bean-to-bar chocolate, and design studio services, plans to utilize the funding to strengthen its talent pool, enhance tech-enabled customer experiences, conduct R&D for product design, and improve farm-level infrastructure for speciality green coffee and fine cacao beans.

- With a post-funding valuation of $34 million, Subko also aims to launch new ready-to-drink coffee products, expand its presence in tier-1 cities in India and global regions

AdOnMo Secures $7M in Series B1 Round

- Indian Ad-tech firm AdOnMo has raised Rs 58.21 crore (approximately $7 million) in its Series B1 round, marking its first significant funding since Zomato's Series A investment last year.

- Founded in 2016, AdOnMo specializes in targeted digital advertising on outdoor digital screens across 21 cities. With this latest round, the company has raised approximately $25 million in total funding and is valued at around $105 million post-money.

- AdOnMo plans to utilize the funds for business expansion and meeting working capital requirements, according to regulatory filings. The round saw participation from healthcare veteran Ravindranath Kancherla, his son Kancherla Pruthvinath, Qatar Insurance Company, ZNL Growth, and several individual investors.

SuperK Raises $6M to Expand Tech-Enabled Supermarkets in Small-Town India

- SuperK, a franchise-based retail chain in India, has secured $6 million in Series A funding led by Blume Ventures and Silver Needle Ventures.

- Founded in 2020 by Anil Thontepu and Neeraj Menta, SuperK brings tech-enabled supermarkets to small towns, offering customers an organized retail experience. It uses technology for detailed purchase analysis, helping stores understand customer buying patterns and customize offers. SuperK currently operates in over 80 towns in Andhra Pradesh, serving over 500,000 families.

- The funding will support SuperK's plans to enhance its tech infrastructure, expand its team, and onboard digitally native brands onto its platform.

Kamereo Raises $2.1M to Expand Food-Sourcing Platform

- Vietnam-based B2B food-sourcing platform Kamereo has secured $2.1 million in a pre-Series B round led by Reazon Holdings and Thoru Yamamoto, CEO of Tokyo-listed B2B firm Foodison. Quest Ventures also participated in the funding round.

- Founded in 2019, Kamereo facilitates online marketplace transactions between farmers and food and beverage businesses, focusing on fresh supplies.

- With the new funding, the company plans to expand its presence within Vietnam, particularly in Hanoi and aims to enter the Cambodian market. Additionally, Kamereo will use part of the funds to develop its consumer retail business, selling ready-to-eat salads through supermarkets and convenience stores.

Follow our full coverage of the Asian startup and technology scene and get up to date with what's happening in the key markets within the region.